As digital finance operations evolve, so do the risks associated with payment fraud. Tactics like check fraud, phishing emails, and vendor impersonation continue to impact organizations of all sizes. Managing those risks requires more than reactive measures — it requires a system built with prevention in mind.

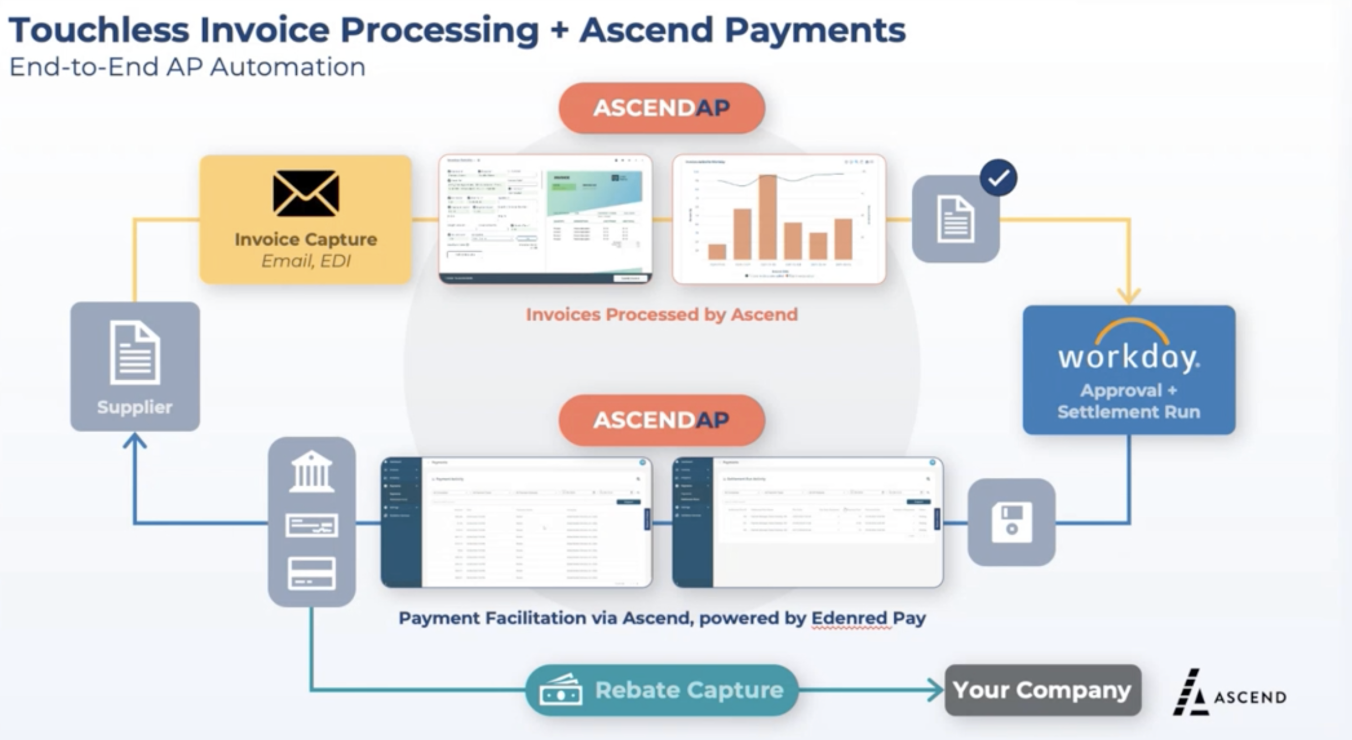

Ascend’s Payments platform incorporates multiple layers of fraud protection, structured around secure processing practices and supported by Edenred, a licensed financial institution.

One of the key ways to limit payment fraud is by reducing the visibility of banking information. With Ascend, payments are not issued directly from a company’s own bank account. Instead, disbursement is handled through Edenred’s banking infrastructure. This keeps account and routing numbers off of outgoing ACH files and paper checks.

For virtual card payments, each transaction uses a single-use card number tied to that payment only. If those credentials are intercepted, they are not reusable — reducing the risk of misuse.

Regulated Processing Environment

Because Edenred is federally regulated, all payments processed through the system are subject to compliance protocols that include anti-fraud and anti-money laundering checks. While Edenred provides the infrastructure to meet these standards, Ascend manages the end-to-end workflow.

This setup allows finance teams to maintain visibility into the process, while reducing the internal burden of managing compliance-related details themselves.

Vendor Onboarding With Verification Steps

A common entry point for fraud is the vendor enablement process. Fraudsters often pose as legitimate vendors or request changes to existing payment details. To address this, Ascend facilitates a controlled vendor onboarding process, which includes direct supplier verification.

Vendors are given access to a secure portal where they can review invoice status and remittance details. This approach helps reduce the need for invoice inquiries — which are often used in phishing attacks — and keeps communication within a secure environment. During onboarding, Ascend also supports data cleanup to prevent issues like duplicate or outdated vendor records.

Real-Time Payment Visibility

Having access to real-time payment status is important for both operational efficiency and fraud detection. Ascend provides status updates throughout the payment lifecycle, from submission to settlement.

This visibility helps teams reconcile payments more quickly, identify irregularities sooner, and maintain better control over outbound payment activity — particularly useful for high-volume AP environments.

Final Notes

Payment fraud prevention relies on a combination of secure processes, accurate data, and limited exposure to sensitive information. Ascend’s Payments platform is designed with these factors in mind, using a structure that blends process control with regulated financial infrastructure.

The system supports a range of payment types, including check, ACH, and virtual card, and emphasizes visibility and verification at each step. For organizations focused on reducing risk in their accounts payable operations, this approach offers a practical, systems-based path forward.