For businesses that rely on manual invoice and payment processing, the cost savings and efficiency gains of implementing an automation solution can be significant. By automating AP processes, companies can reduce time spent on manual processing and processing costs, while improving accuracy and reducing the risk of errors.

In this blog, we'll explore how to calculate the ROI of AP automation using an ROI calculator and explain how an automation solution can benefit your business's bottom line.

Step 1: Determine Your Current Costs

Before calculating the ROI of an AP automation solution, you need to understand your current costs for invoice and payment processing. This includes the time spent on manual processing, the number of employees involved, and any processing costs associated with the current process.

There are several metrics that can be used to measure the cost of operating an accounts payable department. While many companies only associate headcount and expenses of the department, there are many other metrics that would be optimized by integrating AP Automation software into the business process - therefore should be entered into the ROI equation.

Some of the most commonly used metrics include:

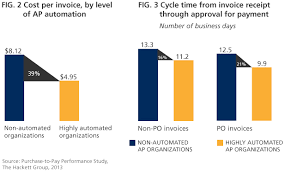

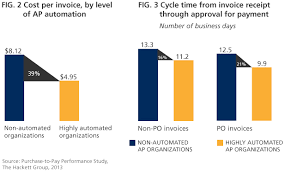

- Cost per invoice: This metric measures the total cost of processing an invoice from receipt to payment. It includes both direct and indirect costs, such as labor, software, and hardware. By measuring the cost per invoice, organizations can identify areas for cost reduction and process improvement.

- Invoice processing time: This metric measures the amount of time it takes to process an invoice, from receipt to payment. A longer processing time can result in late payments, missed discounts, and increased costs. By measuring invoice processing time, organizations can identify bottlenecks and inefficiencies in the process.

- Invoice accuracy rate: This metric measures the percentage of invoices that are processed without errors. An inaccurate invoice can result in payment delays, duplicate payments, and other issues. By measuring the invoice accuracy rate, organizations can identify areas for improvement in the process, such as training or software enhancements.

- Accounts payable staffing costs: This metric measures the cost of labor associated with the accounts payable department, including salaries, benefits, and other related expenses. By measuring staffing costs, organizations can identify opportunities to reduce costs or optimize their workforce.

- Early payment discounts: This metric measures the percentage of invoices that are paid early, and the associated discounts received. By measuring early payment discounts, organizations can identify the potential for cost savings through improved payment terms and negotiating better discounts.

- Invoice cycle time: This metric measures the time it takes to complete a full invoice cycle, from receipt to payment. This includes time spent on invoice processing, approval, and payment. By measuring the invoice cycle time, organizations can identify areas for process improvement and potential cost savings.

- Supplier satisfaction: This metric measures the satisfaction level of suppliers with the accounts payable process. A higher level of supplier satisfaction can result in better supplier relationships, improved payment terms, and potential cost savings. By measuring supplier satisfaction, organizations can identify areas for improvement in the process and potentially reduce costs.

Step 2: Evaluate the Cost of an Automation Solution

Once you have a clear understanding of your current costs, you can evaluate the cost of an AP automation solution. This includes the cost of the software, any implementation costs, and ongoing maintenance fees.

Step 3: Calculate the Potential Savings

Using an ROI calculator, you can estimate the potential savings of implementing an AP automation solution. This includes the time saved on manual processing, reduced processing costs, and improved accuracy. By inputting your current costs and the cost of the automation solution, the ROI calculator can estimate your business's potential savings and ROI.

Step 4: Consider the Benefits

In addition to cost savings, there are other benefits to implementing an AP automation solution. This includes improved accuracy, faster processing times, and the ability to scale as your business grows.

By automating AP processes, companies can also reduce the risk of fraud and increase visibility into the invoicing and payment process. This can be particularly valuable for companies with large volumes of invoices and payments.

Step 5: Make the Decision

With a clear understanding of your current costs, the potential savings of an automation solution, and the benefits it can provide, you can make an informed decision about whether to invest in AP automation.

Ultimately, an AP automation solution can help streamline your business's invoicing and payment processes, reduce costs, and improve accuracy. By leveraging technology to automate manual processes, you can free up your employees' time to focus on more strategic tasks that drive business growth.

Using an ROI Calculator

An ROI calculator takes into account the current processing costs, the potential cost savings, and the implementation and maintenance costs of the automation solution. By inputting these factors, companies can determine the potential ROI of the solution.

For example, let's say a company currently spends $50,000 per year on processing invoices and payments manually. By implementing an AP automation solution, the company estimates it can reduce processing time by 50%, resulting in a cost savings of $25,000 per year. The implementation and maintenance costs of the automation solution are estimated at $15,000 per year. Using an ROI calculator, the potential ROI of the solution is calculated as follows:

ROI = (Cost Savings - Implementation and Maintenance Costs) / Implementation and Maintenance Costs x 100%

ROI = ($25,000 - $15,000) / $15,000 x 100%

ROI = 66.7%

This means that the company can expect to see a return on investment of 66.7% by implementing the AP automation solution.

Conclusion

AP automation solutions can provide significant cost savings and process improvements for companies. By streamlining invoice and payment processing, companies can reduce manual processing time and costs, resulting in increased efficiency and profitability. To calculate the ROI of an AP automation solution, companies can use an ROI calculator to determine the potential cost savings and implementation costs. With the right automation solution in place, companies can achieve significant ROI and transform their AP processes for the better.