In the realm of financial operations, accounts payable holds a crucial role. However, it is not without its fair share of challenges. Managing invoices, payments, and vendor relationships can be a complex and labor-intensive process, prone to various pains that hinder efficiency and accuracy. In this blog, we will explore the top pains of accounts payable and discuss strategies to overcome them.

1. Manual and Paper-Based Processes

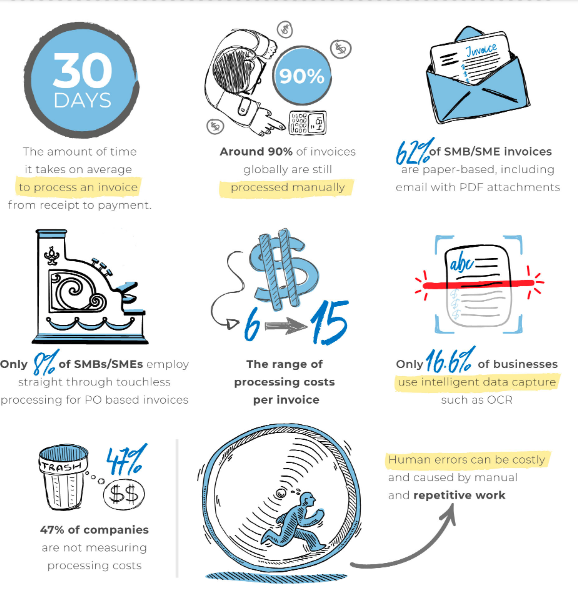

One of the most significant challenges faced by accounts payable departments is the reliance on manual and paper-based processes. Handling a high volume of invoices and payment documents manually not only consumes valuable time but also increases the risk of errors.

Source

Transitioning to digital solutions, such as automated invoice capture and document management systems, can streamline workflows, reduce manual data entry, and enhance accuracy.

2. Invoice Processing Delays

Delays in invoice processing can lead to strained supplier relationships, missed early payment discounts, and even late payments. Traditional approval processes, lengthy paper trails, and lack of visibility into invoice status contribute to these delays. Implementing automated approval workflows and leveraging technology to capture, validate, and track invoices can expedite the process, ensuring timely payments and improved cash flow.

3. Limited Visibility and Control

Without real-time visibility into invoice status, payment schedules, and outstanding liabilities, accounts payable departments may struggle to gain control over their processes. This lack of visibility makes accurate financial reporting and decision-making challenging. Utilizing accounts payable automation software with robust reporting and analytics capabilities can provide comprehensive insights into payables, enabling proactive management and improved decision-making.

4. Data Entry Errors

Manual data entry increases the risk of human errors, such as incorrect amounts, duplicate entries, or mismatched vendor information. These errors can lead to payment discrepancies, reconciliation challenges, and strain relationships with vendors. Leveraging optical character recognition (OCR) technology and implementing automated data capture solutions can significantly reduce data entry errors, ensuring accuracy and reconciliation efficiency.

5. Limited Supplier Communication and Collaboration

Effective communication and collaboration with suppliers are essential for resolving invoice discrepancies, addressing payment inquiries, and maintaining strong relationships. Inadequate communication channels and manual processes hinder these interactions, resulting in prolonged dispute resolution and potential delays. Implementing supplier portals or adopting electronic data interchange (EDI) systems can enhance collaboration, facilitate timely communication, and streamline the procurement process.

6. Compliance and Regulatory Challenges

Navigating complex compliance and regulatory requirements is an ongoing challenge for accounts payable departments. Managing tax laws, vendor compliance requirements, and internal audit processes demands attention to detail and diligent adherence. Adopting accounts payable automation solutions with built-in compliance features, such as tax validation and reporting capabilities, helps mitigate compliance risks and ensures adherence to regulatory frameworks.

7. Lack of Automation and Technology

The absence of automation and technology limits the potential for efficiency gains in accounts payable processes. Embracing digital transformation through accounts payable automation solutions empowers businesses to automate routine tasks, streamline workflows, and leverage advanced technologies like artificial intelligence and machine learning. These tools can enhance invoice processing speed, accuracy, and overall efficiency.

Conclusion

Accounts payable may face several challenges, but with the right strategies and technological advancements, these pains can be overcome. Embracing accounts payable automation, digital document management, and robust reporting capabilities can alleviate the burdens associated with manual processes, improve accuracy, enhance visibility, and strengthen supplier relationships. By addressing these pain points head-on, businesses can unlock the full potential of their accounts payable department and drive greater efficiency and profitability.