From the outside, accounts payable (AP) processes can seem opaque and mysterious. Often, the manual for this essential function appears to exist solely in the minds of certain AP team members.

Only they possess the full understanding of the microtasks and processes that make up AP invoice processing.

But, there's no reason for this information to only exist in a few brains.

AP is not new. And, its processes, whether manual or automated, are not mysterious. So, your AP processes shouldn’t be either. In fact, these processes—more so, their performance—should be as clear, immediate, and accessible as the meters and warnings on your car's dashboard.

Just as you’d want an alert for a low tank of gas, you need an alert for a stack of invoices about to incur late payment fees.

Just as you’d want an alert for a low tank of gas, you need an alert for a stack of invoices about to incur late payment fees.

Sticking to our car analogy, you might not know whether premium or regular motor oil is right for your vehicle. So, in a pinch, you err on the side of caution and pay the extra $10 for the premium. In AP, you're probably unnecessarily spending money to process invoices; for example, by overpaying some vendors in the form of duplicate payments.

The impact of one overpayment—like the impact of buying the premium motor oil one time—is negligible. But as your company grows these “oversights” often multiply exponentially.

Do you know what duplicate payments are costing your organization over the course of year? Do you know how many hours it takes per week for your AP team to fix errors on your incoming invoices or how many hours it takes to get approvals? How about early payment discounts? Do you know how many you're missing out on each month?

Some would say that those losses are the cost of doing business. But they don't have to be. And, in 2021, they shouldn't be. Utilizing statistical data, we created this three-part eBook to uncover the hidden costs and strenuous obstacles to AP processing efficiency, and to provide a solution for avoiding them.

In part one, we’ll explore the factors that make AP processing inefficient and costly. In part two, we’ll point out the events that cause your business to lose money unnecessarily. Finally, in part three, we’ll show how AP automation through machine learning solutions greatly increase processing speed, eliminate mistakes, and process a high number of invoices automatically without ever being touched by a human.

%20(1).jpg?width=574&name=Ascend_Deliverable1_Infographic%20(1)%20(1).jpg)

Your costs are… costly. It’s interesting to consider that the function of processing and paying invoices has significant costs associated with it. Maybe “interesting” is the wrong word.

But as a central function to your company’s financial operations, the amount of time spent on AP processing without automation is significant. However, even with standard features of an automation strategy such as document scanning and automated approvals, the lack of additional Procure to Payment (P2P) solutions to augment your process can further stagnate an AP team’s productivity.

Factors that affect invoice processing cost include:

Within those major tasks are smaller tasks that make processing possible. But they take up a considerable amount of time to handle alone. Moreover, most AP teams field a variety of other tasks, such as supplier inquiries, outside of the more crucial functions they should be spending more of their time on.

This chapter will explore the hidden and not-so-hidden costs of AP, explain how they got so high, and introduce a simple solution for getting them under control.

Purchase order (PO) invoices are part of a traditional processing method familiar to any business. After all, POs are pre-approved and sent to the supplier for fulfillment. All the AP team needs to do is match the order against the PO when it arrives. Seems straightforward, right?

That PO-based invoice still requires data entry, which could be helped with an easy-to-access method that automates tasks like searching for the PO itself to verify.

On average, 60.5% of invoices processed are PO invoices that should enable a straight-through process. But, without an automated system with tight integration to an ERP, the AP team will likely jump back and forth through verification and entry hoops to get simple PO invoices processed.

At Ascend, our Validation Services team provides the perfect case study in how seconds matter when it comes to AP processing. Normally, this team specializes in processing troublesome invoices—those that stall up automation solutions and can’t be processed straight through to an ERP system. The point is: these are invoice processing pros, as fast as they come. They can process a PO invoice manually (without automation software) in about three minutes.

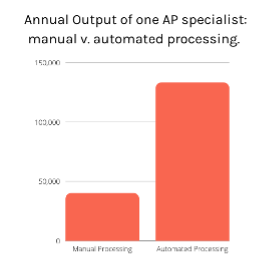

Using that number and considering the roughly 250 working days in a year, one of our pro processors could get through about 40,000 PO invoices each year—if all they did was process invoices for 8 hours a day and with zero mistakes. Of course, these conditions don’t exist in the real world, but for the purposes of this example, just stay with us.

Using that number and considering the roughly 250 working days in a year, one of our pro processors could get through about 40,000 PO invoices each year—if all they did was process invoices for 8 hours a day and with zero mistakes. Of course, these conditions don’t exist in the real world, but for the purposes of this example, just stay with us.

Now, consider that it takes our same pros 54 seconds to process an invoice using Ascend’s AP Automation solution. Again, under perfect conditions (if all they did was process invoices for 250 days/year and never made mistakes), that translates to 133,333 PO invoices per specialist each year.

Let’s flip the example and look at the hours saved. A company processing 100,000 PO invoices each year would save 3,500 hours by leveraging automation. That’s 3,500 hours that their AP team could use on higher value tasks—and that’s just the PO invoices. The savings with non-PO invoices are far more significant.

If PO invoices are enough to keep an AP team busy, non-PO invoices monopolize even more of an AP team’s time.

Non-PO invoices, or invoices without a purchase order, can send your team onto a paper trail and approval chase for hours or days.

One of the major challenges AP teams face is with invoice approval time. The time required to search for the origin of a non-PO invoice, determine proper coding, and confirm approvers significantly increases standard processing time and draws a team away from more considerable tasks. Without an intelligent integration that can access information, perform lookups, and kickoff approvals in real-time, an AP team faces stagnated processing and increased risk of errors.

Let’s return to the invoice processing pros. Our Validation Services AP team can process a non-PO invoice manually (no automation) in 6 mins—twice the time it takes to process PO invoices. But, using Ascend AP Automation, they can process those same invoices in 1 minute and 48 seconds.

Imagine a company that receives 100,000 non-PO invoices each year. Assume their AP team is perfect; they make zero mistakes and spend 100% of their time processing. By moving to an automated system, they could save 7,000 processing hours (10,000 manual v. 3,000 automated). And, that’s assuming that none of their invoices are passed to their ERP automatically.

In reality, we have Ascend customers auto-passing 90%+ of their invoices to their ERP. Applied to the example above, that would mean processing just 10k of their 100k non-PO invoices annually and moving from 10k hours of processing to just 300.

Learn how to eliminate duplicate payments in your AP department and 5 other needless costs in our new eBook.

Additional insights: