As businesses strive to stay competitive in today's fast-paced world, finding ways to improve efficiency is crucial. One area where this is particularly important is in accounts payable (AP) processes.

By streamlining AP workflows, organizations can reduce costs, improve accuracy, and free up valuable resources for other tasks. But how do you measure AP efficiency, and what metrics should you be using?

In this blog, we'll explore some of the key metrics used to evaluate AP performance, as well as strategies for improving efficiency. Additionally, below is a video that offers valuable insights and tips for optimizing your AP processes. So whether you're looking to streamline your accounts payable workflows or simply curious about how to measure AP efficiency, keep reading to learn more.

Improving Vendor Relationships

Improving vendor relationships can have a significant impact on accounts payable efficiencies.

Here are some ways in which it can be achieved: accounts payable process improvements.

-

Clear communication: Open communication is essential for a healthy vendor relationship. Regular communication with vendors can help address issues and resolve problems in a timely manner, reducing the likelihood of delays or errors in the AP process.

-

Maintaining good relationships: Good relationships with vendors are a critical part of the AP function. By building and maintaining friendly relationships with vendors, AP teams can foster a sense of trust and collaboration, which can help to resolve issues quickly, have favorable terms, and more.

-

Negotiate favorable terms: Negotiating favorable payment terms with vendors can help improve cash flow and reduce the risk of late payments. This can include discounts for early payments, extended payment terms, or other incentives.

-

Collaboration on process improvements: Working collaboratively with vendors to identify areas for process improvement can help streamline AP processes and reduce errors. For example, vendors may be able to provide electronic invoices or use a web-based portal for submitting invoices, which can help reduce manual data entry and processing times.

-

Vendor evaluation: Regularly evaluating vendor performance can help identify areas for improvement and ensure that vendors are meeting expectations. This can help improve the quality of goods or services received and reduce the risk of errors or delays.

Improving vendor relationships takes time and effort, but the benefits can be significant in terms of improved AP efficiencies, reduced costs, and stronger supplier partnerships.

Top Metrics

- Average Payment Terms

- Spend by Vendor

- Days Payable Outstanding

%20Base%20Camp%20Scanning%20invoices%20with%20OCR%20software.png?width=2240&height=600&name=Copy%20of%201)%20Base%20Camp%20Scanning%20invoices%20with%20OCR%20software.png)

Centralizing Accounts Payable

Centralizing accounts payable (AP) refers to consolidating all AP functions within a single department or location. This can include activities such as invoice processing, vendor management, and payment processing. Centralizing AP can help increase efficiency in several ways:

-

Standardization: Centralizing AP allows for the development and implementation of standardized policies and procedures. This can help reduce errors and inconsistencies in the AP process, as well as improve compliance with regulatory requirements.

-

Streamlined processes: With all AP functions in one location, it is easier to identify areas for process improvement and implement changes. This can help streamline the AP process, reducing the time and effort required to complete tasks such as invoice processing and payment approvals.

-

Improved vendor relationships: Centralizing AP can help build stronger relationships with vendors. By having a single point of contact for all vendor-related activities, it is easier to establish clear communication and negotiate favorable terms, such as discounts for early payments.

-

Enhanced visibility: Centralizing AP provides greater visibility into AP-related activities and expenses. This can help identify areas for cost savings and improve budgeting and forecasting.

-

Reduced costs: Centralizing AP can help reduce costs by eliminating redundancies and improving efficiency. This can include reducing the number of staff required to manage AP functions, as well as reducing the time and effort required to process invoices and make payments.

Overall, centralizing AP can help increase efficiency, reduce costs, and improve vendor relationships, making it an attractive option for many organizations. However, it is important to carefully plan and implement a centralization strategy to ensure that it is successful and achieves the desired outcomes.

Reducing Paper Invoices

Reducing paper invoices can have a significant impact on accounts payable (AP) efficiencies.

Here are some benefits of moving away from paper invoices:

-

Faster processing: Electronic invoices can be processed faster than paper invoices because they can be automatically routed to the appropriate individuals for review and approval. This can help reduce delays and improve payment times.

-

Lower processing costs: Processing paper invoices can be costly due to the need for manual data entry, paper storage, and printing. Electronic invoices can reduce these costs by eliminating the need for paper and reducing the time and effort required for manual data entry.

-

Improved accuracy: Electronic invoices can be automatically matched with purchase orders and receipts, reducing the risk of errors and discrepancies. This can help ensure that payments are accurate and compliant with regulatory requirements.

-

Improved visibility: Electronic invoices provide greater visibility into AP-related activities and expenses. This can help identify areas for cost savings and improve budgeting and forecasting.

-

Enhanced security: Electronic invoices are typically more secure than paper invoices because they can be encrypted and stored in a secure, centralized location. This can help reduce the risk of fraud and unauthorized access.

-

Improved vendor relationships: Electronic invoicing can help improve vendor relationships by providing faster, more accurate payments and reducing the risk of errors or delays.

Overall, reducing paper invoices can help increase efficiency, reduce costs, and improve accuracy and compliance in the AP process. It can be particularly beneficial for organizations that process a high volume of invoices or have complex AP workflows. However, it is important to ensure that the organization's suppliers are capable of providing electronic invoices before implementing this change.

Top Metric

- Number of Electronic vs Paper Invoices

Accounts Payable Automation Solution

AP automation refers to the use of technology to streamline and automate accounts payable (AP) processes.

Here are some ways in which AP automation can increase efficiency:

-

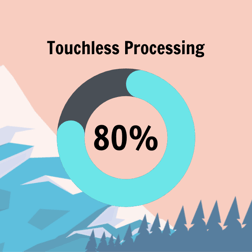

Faster invoice processing: AP automation can help reduce the time and effort required to process invoices. Electronic invoices can be automatically matched with purchase orders and receipts, reducing the need for manual data entry and processing.

-

Improved accuracy: Automated AP processes are less prone to errors than manual processes. This can help reduce the risk of duplicate payments, incorrect data entry, and other errors that can lead to delays and additional costs.

-

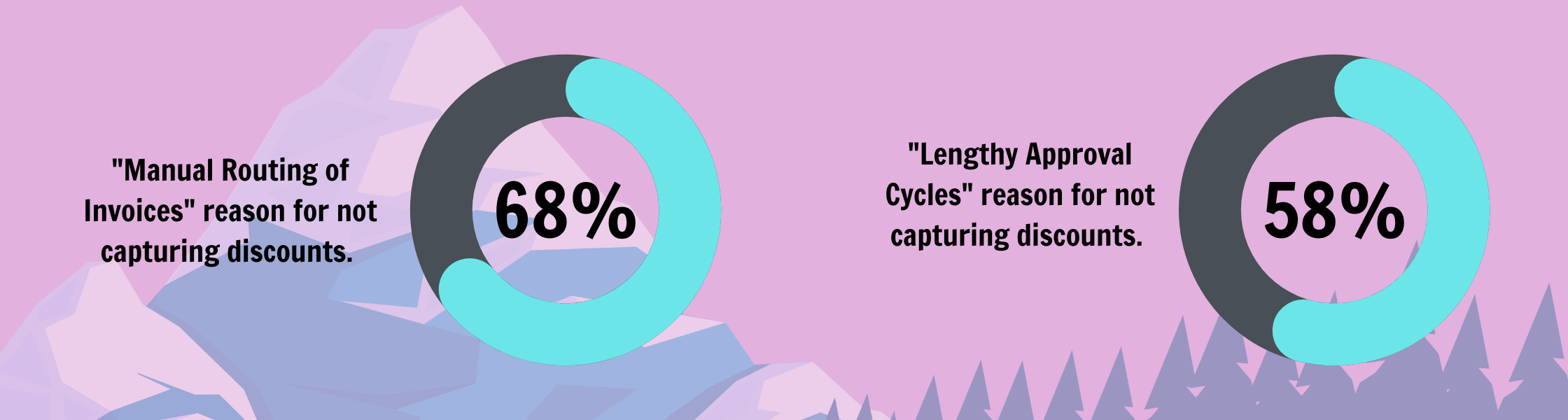

Faster approvals: AP automation can help speed up the approval process by routing invoices and payment requests to the appropriate individuals automatically. This can help reduce delays and ensure that payments are processed in a timely manner.

-

Reduced manual tasks: Automating routine tasks such as data entry, invoice processing, and payment approvals can help free up staff time for more strategic activities. This can help improve employee productivity and job satisfaction.

-

Enhanced visibility: AP automation provides greater visibility into AP-related activities and expenses. This can help identify areas for cost savings and improve budgeting and forecasting.

-

Improved vendor relationships: AP automation can help improve vendor relationships by providing faster, more accurate payments and reducing the risk of errors or delays.

Overall, AP automation can help increase efficiency, reduce costs, and improve accuracy and compliance in the AP process. It can be particularly beneficial for organizations that process a high volume of invoices or have complex AP workflows. However, it is important to carefully evaluate automation solutions and ensure that they meet the needs of the organization before implementing them.

Review of the Top Accounts Payable Metrics To Measure

- Average payment terms

- Spend by Vendor

- Days Payables Outstanding

- Discounts Captured & Obtained as a percentage of discounts

- Paper vs. Electronic Invoices

- Total number of Invoices Received

- Total Number of Invoices Processed

- Average time taken to process an invoice