Why AP Automation? One of the most impactful things you can do to improve your organization’s Accounts Payable (AP) process is to automate it. AP automation is the use of technology to streamline and automate the invoicing, payments, and PO process.

While many organizations have automated their P2P (Procure to Pay) process, few have automated their Non-PO coding process. Non-PO or Non-purchase order invoices make up a significant portion of most AP departments’ workload.

In this blog post, we’ll discuss the impacts of AP automation on Non-PO coding, including time savings, improved accuracy, and reduced risk.

Why is Non-PO Coding Necessary?

AP Automation solutions, like Ascend AP, allow businesses to shift away from manual processes to more efficient and touchless solutions. It can be used to process both PO and Non-PO invoices.

As a refresher, here are the differences between PO and Non-PO invoices:

- A PO invoice has already had the accounting applied and the costs approved, so the required details are available and obtained from the PO in order to process the invoice.

- A Non-PO invoice is not associated with a PO and therefore has not had the accounting applied such as spend categories or worktags, and will require a great deal of manual input just to be able to submit the invoice for approval. Also, the costs have not yet been approved and will require accurate coding to be applied to ensure the invoice follows the correct approval routing.

Non-PO coding is necessary because not all business expenses can be predicted or planned for in advance. For instance, if a business needs to replace a piece of equipment or make an emergency repair, a purchase order may not be feasible or practical. In such cases, Non-PO coding allows the business to keep track of the expense and allocate it to the appropriate account.

Additionally, Non-PO coding is useful when dealing with small or routine expenses, such as office supplies or travel expenses. These types of expenses are often too small to justify the time and effort required to create a purchase order.

How Does Non-PO Coding Work?

Non-PO coding involves assigning a unique code or identifier to each expense, which is then used to allocate the expense to the appropriate general ledger account.

The coding process can vary depending on the organization's accounting system, but it generally involves the following steps:

The coding process can vary depending on the organization's accounting system, but it generally involves the following steps:

- Identify the Expense: The first step in Non-PO coding is to identify the expense and determine which general ledger account it should be allocated to (In Workday, this may be the spend category). Without automation, this may involve consulting with department heads or reviewing previous expenses to determine the appropriate account.

- Assign a Code: Once the appropriate general ledger account has been identified, a unique code or identifier is assigned to the expense. This code, or Worktag, is used to track the expense and allocate it to the appropriate account.

- Record the Expense: The final step in Non-PO coding is to record the expense in the accounting system using the assigned code. This allows the expense to be tracked and allocated to the appropriate account.

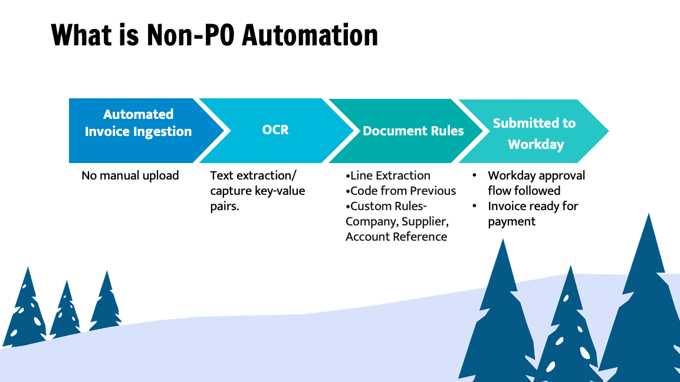

What are document rules?

Ascend AP allows AP Specialists to choose from several different options to setup Non-PO Automation, or “Assign a Code”. These are what Ascend calls Document Rules, which allows each AP department to create rules that automate the process of moving an invoice to the correct worktag to get approved in Workday Financial Management.

Each rule provides its own benefits listed below:

Code from Last Invoice

This option simply pulls through the coding from the current suppliers most recent submitted invoice. The coding will automatically be applied to future invoices once the rule is set up. The rule will continue to be used until it’s changed or disabled and if that happens it will not affect any lines of invoices that have already been processed.

Line Extraction

This option extracts the detail from the invoice image, creates the line and learns how to code future invoices based on the invoice description and item number which is extracted from the invoice image.

You can see a Non-PO invoice that was automatically entered into Workday, with all header and line detail completed in the video at the bottom of this blog.

Custom Rules

Custom Rules allows users to create very specific individual rules. The rule can be created based on Company, Supplier and Account Number if needed.

Again, you can see an example of this in the video located at the bottom of this blog.

The Benefits Of Non-PO AP Automation

When Non-PO coding is set up correctly for an organization, it can have a variety of benefits for a company:

Time Savings

The primary benefit of automating Non-PO invoice coding is time savings. Automation of the process significantly reduces the amount of manual data entry, allowing AP teams to focus on more value-adding tasks.

Accuracy

Automation improves accuracy of the invoice line items and their categorization within the Account Ledger. By eliminating manual data entry there is less room for human error.

Reduce Risk

By automating the entire process from invoice entry to payment, organizations can easily ensure all processes are compliant with local and international regulations. This reduces the risk of non-compliance, which carries costly fines and consequences.

Real-Time Reporting

By automating the coding of Non-PO invoices companies can categorize expenses far faster than the standard manual entry. This gives companies the ability to track, analyze, and manage the performance of vendors in real-time.

Conclusion

Non-PO coding is a valuable tool for organizations that need to track expenses that were incurred without a purchase order. By assigning a unique code, through a document rule, to each expense and allocating it to the appropriate general ledger account, non-PO coding improves expense tracking, increases efficiency, and provides greater flexibility in spending.

Watch how to Apply Document Rules to Non-PO invoices in the video below:

Want to see how document rules can be applied to the invoices your company receives? No problem. Schedule a personalized demo today.