Accounts Payable (AP) automation is revolutionizing the way businesses manage their invoice and payment processes. By replacing manual tasks with automated systems, AP automation can generate significant cost savings and efficiency improvements. But what do these savings look like in real terms? This blog post delves into the research and survey data to provide a comprehensive picture of the cost benefits of AP automation.

The Cost of Manual AP Processing

Manual AP processing can be surprisingly costly for businesses. According to a study by the Institute of Finance & Management (IOFM), the average cost to process an invoice manually is $15.96. For organizations dealing with high invoice volumes, these costs can quickly escalate.

Source

Benefits of AP Automation

Reduced Processing Costs

The most direct cost saving from AP automation comes from the reduced cost per invoice. A report by Ardent Partners found that the average cost to process an invoice decreases by 60% or more when businesses switch to an automated AP system. Find out in more detail

Early Payment Discounts

Many vendors offer discounts for early payment, but these can often be missed with manual processing due to delays or oversight. With automated systems, these discounts can be captured more consistently. The same Ardent Partners report found that top-performing AP departments capture nearly 75% more early payment discounts than their peers.

Lower Labor Costs

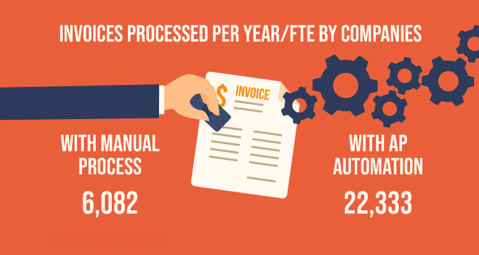

AP automation reduces the time employees spend on manual tasks like data entry and invoice matching, allowing for a reallocation of resources to more strategic tasks. The IOFM found that businesses using AP automation can process 4x as many invoices per full-time employee as businesses using manual processes.

Reduced Late Payment Penalties

Late payments can result in penalties and damage vendor relationships. Automation improves payment timeliness, reducing these unnecessary costs.

The ROI of AP Automation

A study by PayStream Advisors found that businesses using AP automation saw a return on investment (ROI) within 6 to 18 months. The ROI came from a combination of direct cost savings, avoided costs (like late payment penalties), and efficiency improvements.

Moreover, the benefits of AP automation extend beyond cost savings. Automated systems also improve data accuracy, enhance financial control, and provide valuable analytics for better decision-making.

Conclusion

The cost savings potential of AP automation is clear. By reducing processing costs, capturing more early payment discounts, lowering labor costs, and avoiding late payment penalties, businesses can achieve a swift and significant ROI from their automation investment.

However, to fully realize these benefits, it's essential to choose an AP automation solution that fits your business's unique needs and to implement it effectively. Stay tuned to our blog for more insights on how to do just that.

Remember, AP automation is not just about cost savings. It's also about transforming your AP department from a cost center into a strategic asset that drives efficiency, control, and business intelligence.