Accounts Payable (AP) is a crucial function of any organization. It is responsible for managing the payment of bills and invoices to suppliers and vendors. However, many organizations struggle with their AP processes, leading to inefficiencies and financial losses.

In this blog, we will explore some of the most shocking Accounts Payable stats that highlight the importance of streamlining this critical function.

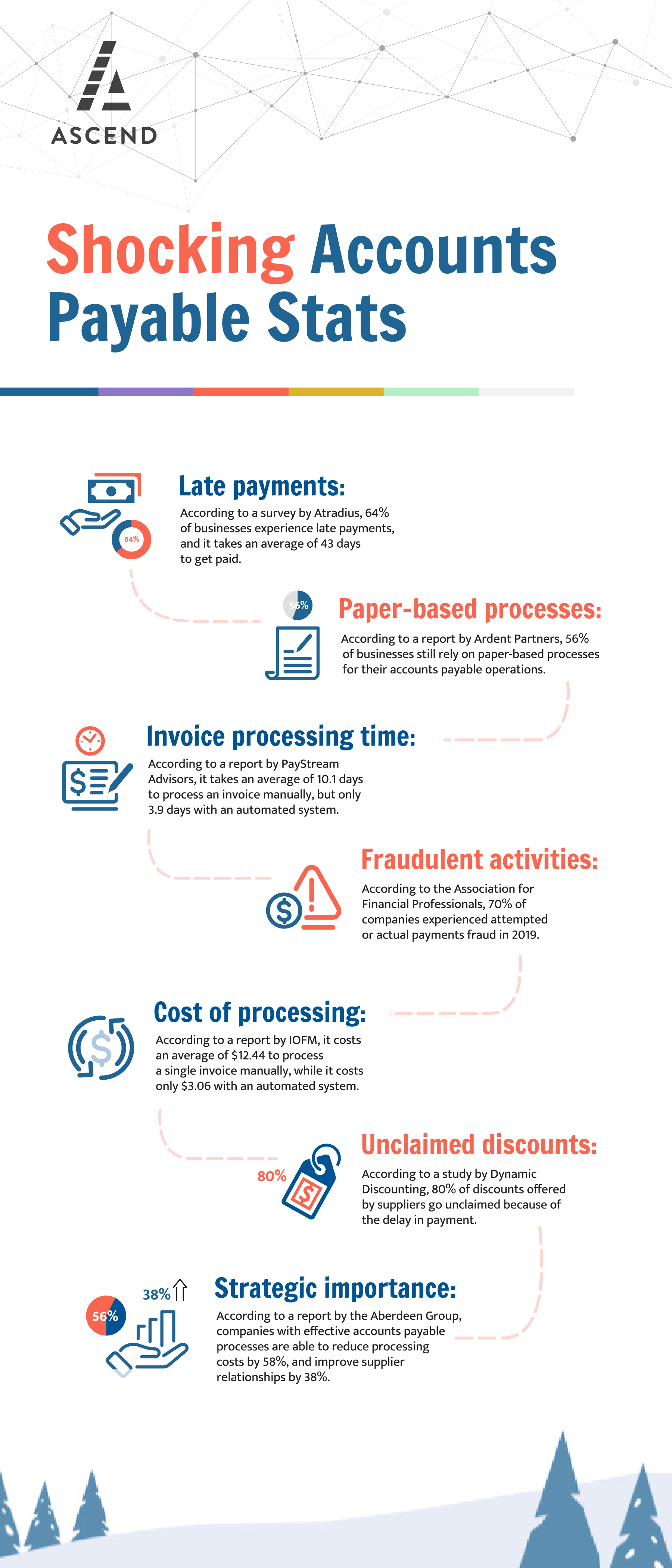

1. The average cost of processing an invoice manually is $15

According to a survey conducted by the Aberdeen Group, the average cost of processing an invoice manually is $15. This includes the cost of paper, printing, postage, and labor. In contrast, the cost of processing an invoice electronically is only $2.36. This means that organizations that still rely on manual invoicing are paying significantly more for the same task.

2. Nearly 40% of invoices contain errors

The Institute of Finance and Management conducted a survey that found that 39% of invoices contain errors. These errors can range from simple mistakes, such as incorrect billing addresses, to more significant issues like overbilling or duplicate payments. These errors can lead to financial losses and damage the relationship between the organization and its suppliers.

3. The average time to process an invoice is 14.6 days

The same Aberdeen Group survey found that the average time to process an invoice manually is 14.6 days. This means that suppliers and vendors may have to wait nearly three weeks to receive payment. This can strain the relationship between the organization and its suppliers and may result in late fees or penalties.

4. Only 39% of organizations have automated their AP processes

Despite the clear advantages of electronic invoicing and automated AP processes, only 39% of organizations have fully automated their AP processes. This means that a significant number of organizations are still relying on manual invoicing, which can lead to inefficiencies and errors.

5. Late payments can result in significant costs

Late payments can result in significant costs for organizations. Suppliers may charge late fees or interest on overdue payments, and late payments can damage the relationship between the organization and its suppliers. A study conducted by Atradius found that 32% of suppliers would stop doing business with a customer if they experienced late payments.

In conclusion, these shocking Accounts Payable stats highlight the importance of streamlining AP processes. Organizations that rely on manual invoicing and paper-based processes are paying significantly more for the same task, and errors and delays can lead to financial losses and damage relationships with suppliers. By automating AP processes, organizations can reduce costs, improve efficiency, and ensure timely and accurate payments to suppliers and vendors.